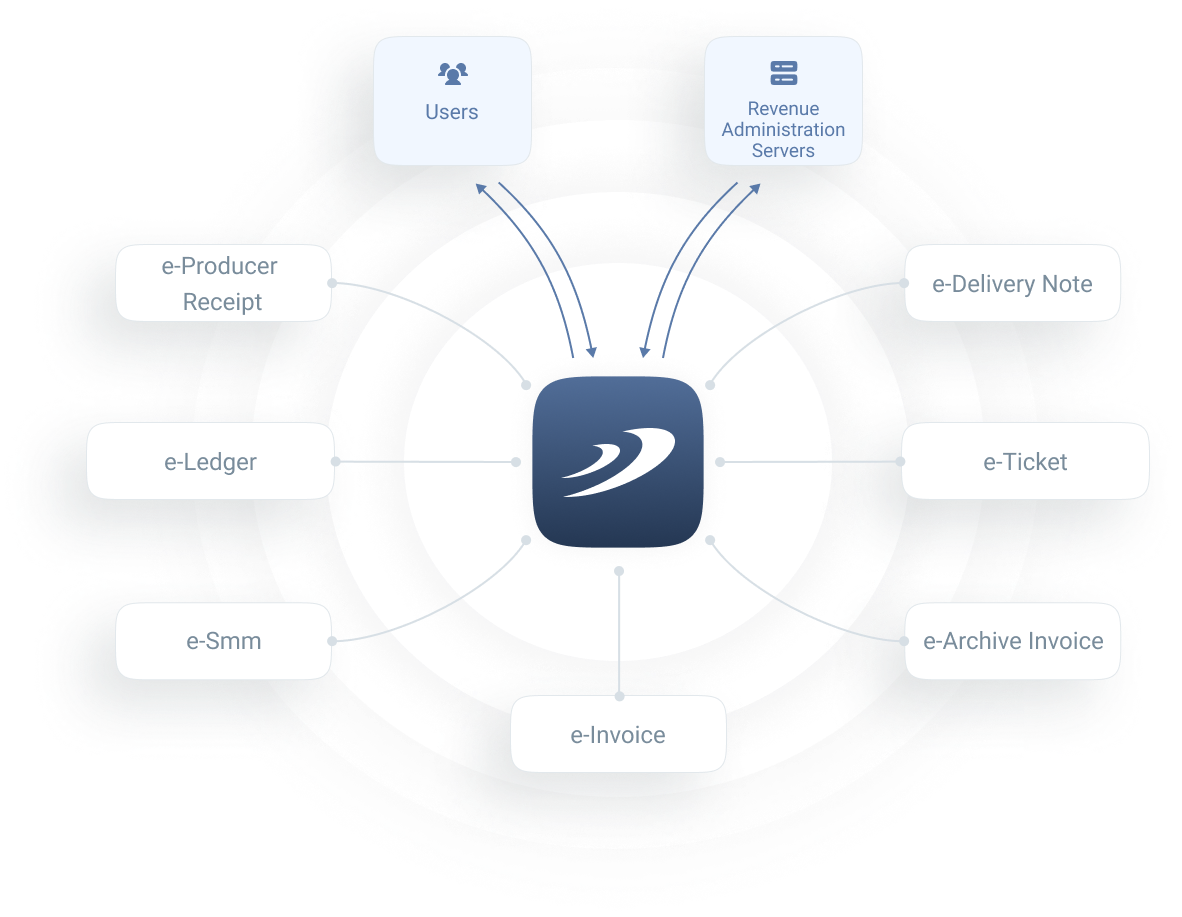

E-Transformation Applications

VBT Yazılım, began providing e-Transformation Services as an Independent Integrator after its e-Transformation software, developed in 2013, was accredited by the Revenue Administration. With the launch of the Flerpi Business Accounting Package in 2021 and the integration of the e-Transformation Package, VBT has taken another step towards providing end-to-end solutions, especially in the retail sector.

You can use the FLERPİ e-Transformation Package either as a cloud service or on-premises (within your own communication network).

e-Transformation Portal: It is the portal used by users to access their e-Transformation application(s). Users with access rights to the portal can view the e-Documents they have sent and received by logging into this environment.

e-Invoice: You can issue the invoices your organization prepares for its customers via the Flerpi e-Transformation Portal and send them to your customers. If you use a different ERP Software, you can integrate the invoices prepared on that software into the e-Invoice module. The generated invoices are signed and enveloped with the e-Flerpi Seal and forwarded to the Revenue Administration servers. Similarly, you can track the invoices sent to you by your suppliers via the e-Transformation Portal and record them in your accounting records. The flow information of the related documents can be tracked via the Flerpi e-Transformation Portal.

e-Delivery Note: You can issue the delivery notes your organization prepares for its customers via the Flerpi e-Transformation Portal and send them to your customers. If you use a different ERP Software, you can integrate the delivery notes prepared on that software into the e-Delivery Note module. The generated delivery notes are signed and enveloped with the e-Flerpi Seal and forwarded to the Revenue Administration servers. Similarly, you can track the delivery notes sent to you by your suppliers via the e-Transformation Portal and record them. The flow information of the related documents can be tracked via the Flerpi e-Transformation Portal.

e-Archive Invoice: You can issue the e-Archive invoices you will prepare for your retail customers via the Flerpi e-Archive Invoice application and send them to your customers. The generated invoices are signed and enveloped with the e-Flerpi Seal and forwarded to the Revenue Administration servers. The flow information of the related documents can be tracked via the e-Transformation Portal.

e-Smm: If you are a self-employed professional, you can issue the Professional Service Receipts you will prepare for your customers from the Flerpi e-Smm application and send them to your customers. The generated professional service receipts are signed and enveloped with the e-Flerpi Seal and forwarded to the Revenue Administration servers.

e-Producer Receipt: You can document the payments you make in return for the products you buy from farmers who are not required to keep records by issuing a Producer Receipt via the e-Producer Receipt application. The generated producer receipts are signed and enveloped with the e-Flerpi Seal and forwarded to the Revenue Administration servers.

e-Ticket: The e-Ticket application is a digital ticket system that replaces the classic ticket created in the form of an electronic document that can be used in all air, land, and sea transportation and events. The generated tickets are signed and enveloped with the e-Flerpi Seal and forwarded to the Revenue Administration servers.

e-Ledger: It is the process of electronically storing the journals and general ledgers, which are legally required to be kept according to the Tax Procedure Law and the Turkish Commercial Code, without printing them on paper, prepared in accordance with the format and standards set by the Revenue Administration. Your e-ledgers, prepared based on the records generated in your ERP or other accounting applications, are signed and enveloped with the e-Flerpi Seal and forwarded to the Revenue Administration servers.